Silver IRA: What You Should Know?

Silver IRA or Individual Retirement Account is a manner of diversifying your investments through precious metals. With this, you can buy literal silver coins and bars and store them for safekeeping. Many people are attracted to this investment type because precious metals have a fairly stable value in the market. They’re not heavily affected by economic shifts and tend to have an upward trend in value. Fortunately, Silver IRA Companies and other precious metals are regulated by the IRS in the same way bonds and stocks are regulated. However, few financial managers include this in their services, so most investors independently set up an individual account. This allows you to self-manage your account and have a more direct control on your investment.

Is Silver a Good Retirement Investment?

Silver and other precious metals are considered safe investments because they maintain value even during uncertain times. In the past, silver and gold were used as legal tender and continue to retain high value in the market. If you look at silver’s history over the years, its value is largely unaffected, even during the 2008 housing crisis or the 2020 economic problems brought by the pandemic.

What to Look For in a Silver IRA Company

Investing in precious metals is a good decision – but you should still vet the firm handling your account. Here’s what to consider when deciding: Fair and reasonable marketing methods. There’s no such thing as 100% guarantee in the market and any firm that offers you this is lying. Instead, look for a company that remains reasonable with their promises and aims to inform you instead of scaring you into opening an IRA account.

Informative and upfront.

Dealing in silver and precious metals can be complicated because of the governing laws around it. Look for a firm that allows easy access to useful information. They should be able to provide original and unbiased information through their channels. Reputable. It’s not enough that the company tells you they’re trusted in the industry. You have to find third-party channels that tell you the same thing. Look into their history and find out any existing complaints about the firm.

Things to Consider When Choosing a Silver IRA Company

Once you’ve narrowed your choices, it’s time to dig deeper with each firm. Here’s what to look for:

Track Record and Reputation of the Silver IRA Custodian Company

Go beyond the reviews left at the company’s website. The reliable sources are the Better Business Bureau, TrustLink, and Consumer Alliance. Your Silver IRA company should be listed in these three and have a good rating to go with it. The ratings come from consumers who previously availed of the company services and want to provide feedback for other potential users. Better Business Bureau also provides information about any complaints launched against the company. Ideally, there should no complaints or if there are – it should be resolved. As state regulators, the Better Business Bureau will provide you with the most accurate insight about Silver IRA Custodian. Finally, don’t forget to look into the people behind the business. You want managers and officials who have had extensive experience in the investment industry. We use all these factors when ranking the best silver IRA companies.

Upfront and Reasonable Individual Retirement Account Fees Investment Companies

You may charge yearly fees in two ways: flat fee or a percentage based on your account balance. Of the two, getting a firm that charges a flat fee every year is better. This way, your account balance can increase without excessive costs. A percentage rate can also be hurtful on your part, especially if the market doesn’t develop in your favor. Some even charge if you fail to make deposits or meet a minimum balance.

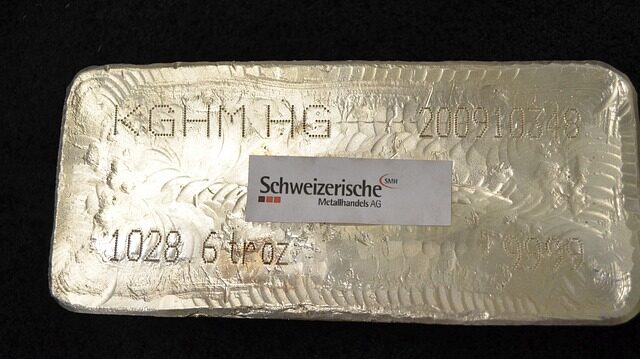

In contrast, a flat fee allows you to have a firm and predictable control of your expenses. You know exactly how much you pay and when. Some companies, like Augusts Precious Metals, go as far as shoulder some of the fees for specific accounts. Silver Storage Safety Unlike other investments – silver is tangible. It needs to be stored and secured by the depository for future use. Storage should be with a reputable company who can guarantee the safety of your silver. It can be local or international stowing and the rates may vary depending on the storage location. The manner of keeping the silver is also crucial. There’s commingled storage where all the silver coins or bullions are placed together in one room. Commingled storage typically means that if you decide to physically withdraw the silver – you won’t be getting your actual metals back.

In contrast, there’s segregated storage where each account holder gets their vault within the vault. This guarantees that all silver deposits are separate and traceable to the person who made the deposit. If you withdraw the silver, you can be sure you’re getting the same item you deposited. Of the two storage methods, segregated storage is usually better. This gives you direct access to precious metals that you purchased yourself. As a result, you know the exact weight, quality, and purity of the silver – making it easier to resell the item if necessary. Generous Company Buyback Policies Are you investing for long-term or short-term? In either case, it’s important to consider how quickly you can liquidate your investment. For this reason, you want to find a company with a buy-back policy. Note that the law doesn’t require these companies to have a buy-back policy.

However – a good company will voluntarily have a buyback program just to give you that added sense of security. A buyback program also means you can quickly sell the silver at current market price values. If the buyback program is too slow and inefficient, the value of silver may fluctuate before the company accepts your sell order. Sincere “Trust Signals” From the Provider Silver is just one of several precious metals that can be used as an investment. A good IRA company should be able to offer all kinds – silver, gold, and platinum. This helps create more diversification in your investments without utilizing multiple companies. You might start with silver, but there’s a good chance you’ll expand to other precious metals as the market changes. Other trust signals you should look for would be the ability of the IRA Company to offer insights about current market trends. For example, August Precious Metals offers access to market analytics generated by their group of economists. This lets you gain access to useful data that you can use to help generate decisions for your investments.

Final Thoughts

Best Silver IRA companies Choosing the right silver IRA Company is crucial if you want to safeguard your future. Diversifying your funds with silver is not enough – each investment must be reliable. After considering all factors, we recommend going with Augusta Precious Metals for your Silver IRA investments. Augusta has a long record of transparency, reliability, and competitive pricing. They also have strong ties with their clients which is easily seen through the ratings and reviews given by patrons of the investment firm. While we’re not saying that Augusta is perfect, it performs better than other Silver IRA firms in the industry today. For your peace of mind, we strongly suggest you research Augusta and contact their management for more information. It’s never too much to do what you can to protect your investments.